III – The Carbon Market (part 2)

1 The Kyoto Protocol Mechanisms

The Kyoto Protocol allows flexible mechanisms in order to reduce emissions. These mechanisms are Emissions Trading (ET), Clean Development Mechanism (CDM) and Joint Implementation (JI). The Kyoto Protocol differentiates Annex I countries to non-Annex I countries. Annex I countries include both parties and observers: the European Community, Australia, Canada, Belarus, Croatia, Japan, New Zealand, Russia, Turkey, Ukraine and the USA; non-Annex I countries include the remaining members participating in the Kyoto Protocol.

1.1 Emissions Trading Systems

1.1.1 EU Emissions Trading Scheme

The European Union Greenhouse Gas Emissions Trading Scheme (EU ETS) was the first emissions trading system in the world. It began to trade carbon credits in January 2005 and it is now the largest carbon trading scheme in the world with $91bn and a volume of 3 GtCO2e traded in 2008. It not only includes the 27 countries from the EU but also Norway, Iceland and Liechtenstein covering 12,000 installations in the energy and industrial sectors like iron, steel, cement and lime, the equivalent of 42% of its total GHG emissions (European Commission, 2008). The units traded are EU allowances (EUAs) as well as carbon credits from CDM and JI.

The EU ETS is developing in three phases:

Phase I (2005-2007): Only CO2 emissions were included as this was a “learning by doing” phase. Countries had to make allocations to businesses through the National Allocation Plan (NAP) which was agreed by the European Commission. As countries did not want to create industries that would not be competitive with other countries, the allocations offered did not reduce CO2 emissions as needed. Some countries gave more allowances than needed under the “business as usual” scenario translating to industries applying zero effort. Only the UK and Germany provided allowances according to the reduction targets. In 2006, prices crashed from €30/t to €10/t when several countries revealed that more allowances were allocated than needed. The price continued to fall to €4/t in January 2007 and finally trading at €0.03/t at the end of 2007. One of the reasons for such a low price was that credits from phase I could not be banked to Phase II (CAN Europe, 2007).

Phase II (2008-2012): In response to the mistakes from Phase I, tighter caps from NAPs were delivered with 3% of allocations auctioned, aiming to reduce EU emissions by 6% below 2005 levels by 2012. However this only happened after the EC asked the countries to review their plans again. Norway, Iceland and Liechtenstein joined the EU ETS (Lazarowicz, 2009).

Phase III (2013 onwards): Rather than member countries delivering their own NAPs, there will be a centralised EU cap. New sectors like aviation will be included as well as other gases. At least 60% of allowances will be auctioned by 2020 and the total reduction will aim at 21% below 2005 levels by 2020. It will be possible to bank allowances from Phase II to Phase III which will avoid the carbon price from collapsing again. CDM and JI credits will be limited to 50% of the abatement effort (Lazarowicz, 2009).

1.2 Clean Development Mechanism

The CDM allows Annex I countries to buy credits from non-Annex II countries. These credits are known as Certified Emission Reduction (CER) credits and can be sold and traded either at the EU ETS, Chicago Climate Exchange (CCX) or Over-The-Counter (OTC) meaning that credits can be sold directly between entities without passing through the EU ETS and in doing this are usually sold at a premium price. The CERs are used by emitters to meet their targets under the Kyoto Protocol. This mechanism helps non-Annex I countries to achieve sustainable development as finance from Annex I countries is invested in low carbon projects (United Nations, 1998).

The Executive Board (EB) oversees the mechanism and issues the CERs. The sum of CERs issued and the CERs that are in the pipeline is equal to 2,762 million CERs (2.76 GtCO2e) until the end of 2012 from 4,467 CDM projects (CDM Pipeline, 2009b).

The majority of projects are from China (34%) and India (26%) but less than 1% comes from the Least Developed Countries (LDC) as emission reduction opportunities are focussed on agriculture, afforestation and reforestation which only accounts for 6%. This is mainly due to the complexity and high cost involved in the process to produce carbon credits and forestry projects will need to be of considerable size be financially viable. REDD and Land Use and Land Use Change and Forestry (LULUCF) are not included in the CDM even though they account for a large share of anthropogenic carbon emissions (UNFCCC, 2009).

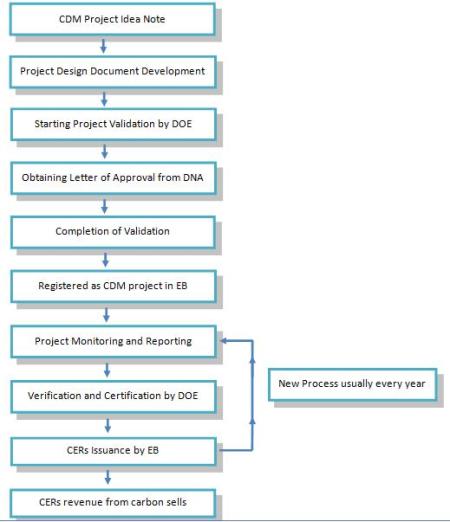

To issue a CER, a project must pass through a number of stages to ensure real, measurable and verifiable reductions are additional. The full process can take between 9 months to 2 years to complete as the life cycle of a project illustrates in Figure 4 – CDM Project Life Cycle, adapted from source (Foundation for Energy, Climate and Environment 2009) and the costs of the entire process can vary between €30,000 to €100,000 depending on the size and type of project.

| Figure 4 – CDM Project Life Cycle, adapted from source (Foundation for Energy, Climate and Environment 2009) |

1.2.1.1 CDM criticism

There are many voices that criticise the CDM, regarding either its concept, efficiency or results. At the Carbon Markets Workshop (LSE/ ICL, 2009) many businesses and institutes (i.e. LSE, ICL, Oxford University, Mission Climat Caisse Depot, International Emissions Trading Association, European Energy Exchange, New Carbon Finance, Swiss Finance Institute and Geo Risks Research among others) were condemning the EB for its slow decision-making process and lack of transparency in project assessment; the industry advises that some projects have been accepted while other similar ones have not, without providing any available explanation as to why this has occurred. The additionality was another source of criticism as a few NGOs are advising that some projects may have been possible without carbon finance and yet carbon credits were still issued. However the main criticism lay in the market being too small to assist sustainable growth in developing countries. The debate concluded with CDM ceasing to exist after 2012 and the carbon market working towards approval on the sectoral approach. The sectoral mechanism will focus on one sector such as power, aviation, cement, steel or forest and will no longer need the EB to oversee that specific sector. A global target for a sector will be decided and each country will oversee the industry and decide the best tool to reduce the emissions (taxes, market, subsidy…). The results will be submitted to the UNFCCC every year and any surplus will be available to be sold into the carbon market.

1.3 Joint Implementation

The Joint Implementation mechanism is very similar to the CDM but did not commence until 2008; the main difference was that the projects are between Annex I countries. For example a company in Germany can invest in a project in Russia and utilise the carbon credits generated to comply with its obligations. The carbon credits created are called Emission Reduction Units (ERUs). To ensure there is no double counting in reducing carbon emissions, the Joint Implementation Supervisory Committee (JISC) oversees the operation and adds the ERUs to the national carbon account. The idea behind JI is to assist transitional economies to sustainable growth; currently Ukraine and Russia are the two main recipients of JI. The additionality is less of a concern as both countries are capped and all emissions are accounted (United Nations, 1998). The size of the JI market is very small compared to CDM as only 20 MtCO2e were traded with a value of $294M.

1.3.1 Hot air with AAUs

Hot air is a term used to express the trade of carbon reduction that has occurred without any legislative effort. For example, the USSR collapsed in 1990 and its emissions have been reduced by 30%. This was not the result of new climate policies, but ex-communist countries are now able to sell this hot air as carbon credits. Concerns have arised regarding a lack of additionality; as carbon emission reductions would have happened even without the Kyoto Protocol (Kant & et al., 2005).

The ETS, CDM and JI are mechanisms developed by the Kyoto Protocol. However some countries did not sign the Kyoto Protocol but internal pressure influenced them to develop a compliance emissions trading outside the Kyoto Protocol.

2 Compliance Emissions Trading Outside the Kyoto Protocol

There are only two other binding cap and trade programs that are operating without any connection to the Kyoto Protocol. There are also other binding cap and trade programs currently being designed around the world that aim to be in operation in the next few years.

2.1 New South Wales GHG Abatement Scheme

The New South Wales GHG Abatement Scheme (NSW GGAS) in Australia started operation in January 2003 and aims to reduce emissions from the power sector. It is expected to stop operations in 2012 and forfeit its position for the inception of the Carbon Pollution Reduction Scheme (CPRS) by 2012. The CPRS is still under consultation but the objectives are to reduce emissions between 5-15% below 2000 levels by 2020. The market is still very small and has only traded 31 MtCO2e worth $183M in 2008 with NSW GHG Certificates (NGACs) traded at around $5 a unit (CORE, 2009).

New developments face problems for the CPRS as the Senate rejected the government’s proposition on an emissions trading scheme on the 13 of August 2009. The government will continue to push for a carbon trading scheme in Australia. A new bill should come through the senate by November which will push for a final decision from parliament by February or March 2010 (Reklev, 13/08/2009).

2.2 Regional Greenhouse Gas Initiative

The Regional Greenhouse Gas Initiative (RGGI) operates in 10 Northeast and Mid-Atlantic states in the US, with a low ambition of reducing emissions by 10% below 2009 until 2018 from power generation over 25MW. It is the first cap and trade program to regulate carbon emissions in the US. The program began in 2005 but was not fully operational until January 2009. One positive aspect is that 85% of the allowances are auctioned. RGGI credits are being traded at less than $3 per tonne. The RGGI market is still in its early stage and its size is relatively small with 65 MtCO2e traded at a value of $246M in 2008; it is expected to grow substantially in the next few years as other states may join and more sectors may be included (Capoor & et al., 2009). New debates around the approval of the Waxman-Markey Climate Bill call for a suspension of RGGI if or when a federal program starts in 2012 (Fontaine, 17/08/2009). According to the RGGI of NY State (Marschilok, 16/08/2009), Maine State (Kennedy, 17/08/2009) and New Hampshire State (Fontaine, 17/08/2009), to date, no offsets have been approved including forestry offsets. Afforestation is the only type of forestry project that can be approved and land must not have been forested for at least 10 years. The regional offices are required to make a determination of completeness on an offset Consistency Application within 30 days of the date of submission. Once a Consistency is determined to be complete, the office is required to assess the determination of consistency within 90 days. Every year the project owner must submit a monitoring and verification report from a third party verifier and the office has to approve or deny it within 45 days. Upon approval of the monitoring and verification report the offset allowance are awarded.

Outside the compliance market, many organizations, businesses and individuals are seeking to reduce their carbon emissions and are looking for other solutions that are cheaper but still provide high quality standard carbon credits. The Voluntary Carbon Market seeks to fill this need.

3 The Voluntary Carbon Market

3.1 The beginning

The Voluntary Carbon Market (VCM) was introduced before the compliance market. The world’s first carbon offset project was set up in 1989 when an American electricity company called AES Corp invested in a carbon sequestration project by paying farmers to plant 50 million trees in Guatemala. Other companies followed the AES example by reducing their carbon footprint for philanthropic and marketing purposes (Hawn, 2005), although the VCM only became what it is known today from 2005-06 onwards. The carbon credits delivered in the VCM are known as Voluntary Emission Reductions (VERs).

One of the advantages of the VCM is that is does not comply with any legal binding caps, therefore any institutions, business or individual can offset their emissions. This freedom gave the VCM the opportunity for a multitude of organizations to sell carbon credits on their own terms. A lot of criticism began to arise against the lack of uniformity, transparency and registration in the VCM. This led to buyers being unable to determine if the credits bought were alleviating climate change at all. In addition, businesses feared criticism from the media if they were not buying high standard credits (Bayon et al., 2007). Ricardo Bayon adds that in 2007 the media began to raise various issues such as additionality in the VCM. In response, suppliers adopted a range of tools, namely carbon standards and registries, thus proving their legitimacy.

In 2008, a multitude of new standards were available in the market such as: Voluntary Carbon Standard (VCS), Gold Standard (GS), California Action Reserve (CAR), American Carbon Registry (ACR), Chicago Climate Exchange (CCX), Greenhouse Friendly, Climate Community and Biodiversity Alliance (CCBA), Carbon Fix, Social Carbon, ISO 14064 and VER+. In addition, the US market began to realise the major business opportunities available in the voluntary carbon market attracting new institutions or businesses to create their own standards and looking for a share of the market or filling the gap of needs not covered by other standards (Capoor & et al., 2009).

3.2 Maturity stage

As the VCM is starting to mature and increase in size, it is possible to break it down in two different markets: the Chicago Climate Exchange (CCX) market and the Over-The-Counter (OTC) market.

– The CCX is an emission trading scheme based in Chicago, USA where organizations voluntarily sign up to a legally binding reductions policy. It is the only cap-and-trade system including all six greenhouse gases in the US.

– OTC includes all the rest of the transactions in the VCM. All operations happen on a case-by-case transaction basis according to the needs of the buyer and supplier following a respective standard. As it is not a cap and trade market, there are no exchange programs.

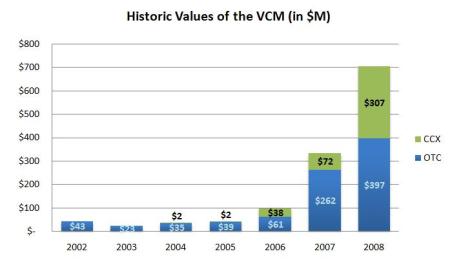

According to Ecosystem Marketplace report on the State of the Voluntary Market (Hamilton, 2009), there are some good news as the VCM begins to mature and 96% of the credits sold were third-party verified in 2008. In addition, the VCS solidified its position as the leading standard in the market followed with 48% of the market share for OTC transactions followed by the GS and CAR with 12% and 10% respectively. The VCM is still relatively small compared to the compliance market with a total of 123.4 MtCO2e traded worth $704.8 million in both CCX and OTC or less than 1% of the total carbon market. It is important to add that the VCM market doubled in size from 2007 to 2008 as shown in Figure 5 – Values of the VCM, source (Hamilton, 2009).

Figure 5 – Values of the VCM, source (Hamilton, 2009)

According to the Ecosystem Marketplace report (Hamilton, 2009), the average price for a VER in the OTC was $7.34/tCO2e in 2008, an increase of 22% from $6.10/tCO2e in 2007 and up 79% from $4.10/tCO2e in 2006. The CCX credits were traded at a much lower price than the OTC with a difference of 66% in 2008. In addition, the price of VERs for project developers was an average of $5.10/tCO2e, $5.4/tCO2e at wholesale level and $8.9/tCO2e sold from retailers, illustrating the increase in costs as credits change hands from project developer to retailer level. Also, the process to obtain VERs is much cheaper than to obtain CERs, varying from $15,000 to $40,000 depending on standard, size and location of the project.

Another important aspect of the VCM is the registry. Registries have been built to increase transparency with the VERs and make sure that VERs sold in the market are not double counted or the same credits sold to different people. For example, the VCS has partnered with three registries (APX, TZ1 and Caisse Dépot) that began working together to ensure that credits in one registry are not replicated in another registry. There have been some delays with the launch of these registries; VCS has been operating without these registries until February 2009 therefore only a limited number of credits have been registered (29% in a third party registry). CAR and Gold Standard also use APX as their registry (Bayon et al., 2007).

Leave a comment